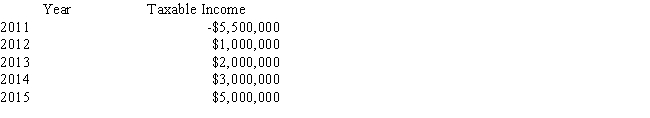

Appalachian Airlines began operating in 2011.The company lost money the first year but has been profitable ever since.The company's taxable income (EBT) for its first five years is listed below.Each year the company's corporate tax rate has been 40%.  Assume that the company has taken full advantage of the Tax Code's carry-back,carry-forward provisions and that the current provisions were applicable in 2011.How much did the company pay in taxes in 2014?

Assume that the company has taken full advantage of the Tax Code's carry-back,carry-forward provisions and that the current provisions were applicable in 2011.How much did the company pay in taxes in 2014?

Definitions:

Costs and Expenses Forecast

An estimate of future costs and expenses that a business expects to incur over a specific period, often used for budgeting and financial planning purposes.

Additional Shifts

Extra work periods added to a company's regular schedule to increase production or cover demand.

Financial Plan

A comprehensive evaluation of an individual's or organization's current pay and future financial state by using current known variables to predict future income, asset values, and withdrawal plans.

Forecast of Sales

An estimate of the future sales volume over a specific period, based on historical data, market analysis, and other factors.

Q4: Discuss three general provisions of the Sarbanes-Oxley

Q7: The basis for classifying assets as current

Q9: According to SFAS No.87,which of the following

Q15: Which of the following would be most

Q15: What is reported on the statement of

Q18: The tax effect of a difference between

Q27: Refer to Exhibit 4.1.What is the firm's

Q41: The real risk-free rate of interest is

Q116: Scranton Shipyards has $7.0 million in total

Q146: At a rate of 5.5%,what is the