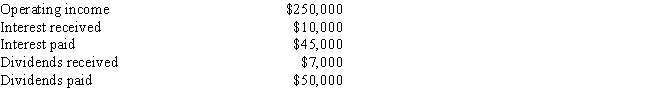

Your corporation has the following cash flows:  If the applicable income tax rate is 40% (federal and state combined) ,and if 70% of dividends received are exempt from taxes,what is the corporation's tax liability?

If the applicable income tax rate is 40% (federal and state combined) ,and if 70% of dividends received are exempt from taxes,what is the corporation's tax liability?

Definitions:

Gain or Loss

The difference between the sale price of an asset and its original purchase price, indicating the financial outcome of a transaction.

Service Potential

This refers to the capacity or ability of a service or asset to provide benefits or usefulness to an entity or its operations.

Land

An economic resource representing natural resources or ground, classified as a fixed asset in accounting, not subject to depreciation.

Declining-Balance Depreciation

A method of accelerated depreciation where an asset loses value by a constant percentage each year over its useful life.

Q6: Other things held constant,the more debt a

Q9: When the allowance method of recognizing bad

Q13: Your brother's business obtained a 30-year amortized

Q13: Define and discuss the accounting treatment for

Q20: When a stock option plan for employees

Q20: Amram Company's current ratio is 2.0.Considered alone,which

Q53: A new firm is developing its business

Q65: Which of the following statements regarding a

Q86: All other things held constant,the present value

Q117: Which of the following statements is CORRECT?<br>A)