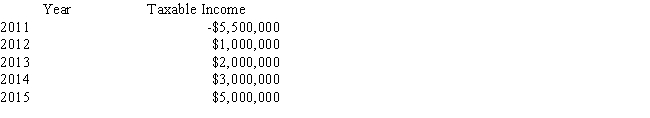

Appalachian Airlines began operating in 2011.The company lost money the first year but has been profitable ever since.The company's taxable income (EBT) for its first five years is listed below.Each year the company's corporate tax rate has been 40%.  Assume that the company has taken full advantage of the Tax Code's carry-back,carry-forward provisions and that the current provisions were applicable in 2011.How much did the company pay in taxes in 2014?

Assume that the company has taken full advantage of the Tax Code's carry-back,carry-forward provisions and that the current provisions were applicable in 2011.How much did the company pay in taxes in 2014?

Definitions:

Permanent Income Hypothesis

A theory suggesting that consumer spending is primarily determined by an individual's long-term income expectations rather than their current disposable income.

Stock Portfolios

Collections of stocks or equities owned by an individual or institution, diversified to manage risk and investment return.

Merrill Lynch

Merrill Lynch, now under Bank of America, is a prominent global wealth management, capital markets, and advisory company.

Realized Capital Gains

Realized capital gains refer to the profits earned from the sale of an asset, like stocks or real estate, which exceed the purchase price, and are only "realized" upon the sale of the asset.

Q3: New Business is just being formed by

Q10: Which of the following statements is CORRECT?<br>A)

Q10: An example of the correction of an

Q14: When a dividend paid to stockholders who

Q14: Companies E and P each reported the

Q16: A purchased patent has a remaining life

Q22: Differences between taxable income and pretax accounting

Q29: Suppose the federal deficit increased sharply from

Q54: If a bank compounds savings accounts quarterly,the

Q137: Vasudevan Inc.recently reported operating income of $4.80