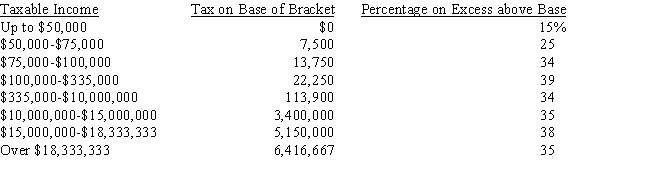

Griffey Communications recently realized $102,500 in operating income.The company had interest income of $25,000 and realized $70,000 in dividend income.The company's interest expense was $40,000.Using the corporate tax schedule below,what is Griffey's tax liability?  Assume a 70% dividend exclusion for tax on dividends.

Assume a 70% dividend exclusion for tax on dividends.

Definitions:

Q4: Discuss the perpetual vs.the periodic methods of

Q6: A transaction that is material in amount,unusual

Q17: A net operating loss carryover that occurs

Q26: If the discount (or interest)rate is positive,the

Q32: The inventory turnover ratio and days sales

Q47: Assume that two firms are both following

Q68: Assuming the pure expectations theory is correct,which

Q74: An increase in accounts receivable represents an

Q98: You agree to make 24 deposits of

Q102: Which of the following statements is CORRECT?<br>A)