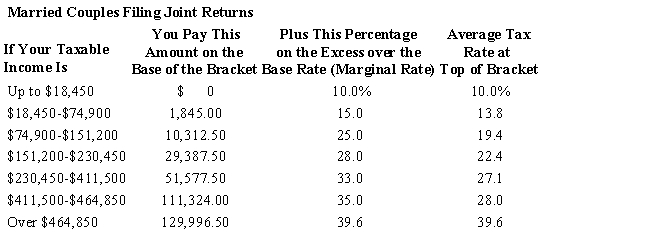

Alan and Sara Winthrop are a married couple who file a joint income tax return.They have two children,so they claim a total of 4 exemptions.In addition,they have legitimate itemized deductions totaling $25,750.Their total income from wages is $237,500.Assume the following tax table is applicable:

What is their federal tax liability?

Definitions:

Cheerfulness

A state of being visibly happy, positive, and showing a bright outlook.

Emotional Labor

The process of managing one’s feelings to present positive emotions even when they are contrary to one’s actual feelings.

Display Rules

Basic norms that govern which emotions should be displayed and which should be suppressed.

Basic Norms

Fundamental guidelines or rules that are understood and shared within a social group, guiding members' behavior and interactions in consistent and predictable ways.

Q18: What is the title of the form

Q22: Which of the following statements is CORRECT?<br>A)

Q24: IFRS No.10 changes the method of reporting

Q32: When a corporation's shares are owned by

Q35: Which of the following bank accounts has

Q51: Which of the following statements is CORRECT?<br>A)

Q74: Companies HD and LD have the same

Q117: Your child's orthodontist offers you two alternative

Q150: Your company has just taken out a

Q152: Time lines cannot be constructed for annuities