Exhibit 8A.1

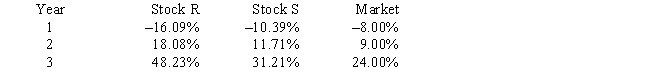

You have been asked to use a CAPM analysis to choose between Stocks R and S,with your choice being the one whose expected rate of return exceeds its required return by the widest margin.The risk-free rate is 5.00%,and the required return on an average stock (or the "market") is 9.00%.Your security analyst tells you that Stock S's expected rate of return is equal to 12.00%,while Stock R's expected rate of return is equal to 14.00%.The CAPM is assumed to be a valid method for selecting stocks,but the expected return for any given investor (such as you) can differ from the required rate of return for a given stock.The following past rates of return are to be used to calculate the two stocks' beta coefficients,which are then to be used to determine the stocks' required rates of return:

Note: The averages of the historical returns are not needed,and they are generally not equal to the expected future returns.

-Refer to Exhibit 8A.1.Set up the SML equation and use it to calculate both stocks' required rates of return,and compare those required returns with the expected returns given above.You should invest in the stock whose expected return exceeds its required return by the widest margin.What is the widest positive margin,or greatest excess return (expected return − required return) ?

Definitions:

Demand

The quantity of a good or service that consumers are willing and able to purchase at various prices.

Supply

The total amount of a good or service available for purchase by consumers at a given price level and time.

Equilibrium Quantity

The quantity of a good or service at which the quantity demanded equals the quantity supplied at the market price.

Demand

The consumer's desire and willingness to pay for a product or service at a specific price.

Q5: Which of the following is not a

Q6: When a closely held corporation issues preferred

Q17: Refer to Exhibit 7A.1.What is the nominal

Q31: Which of the following statements is CORRECT?<br>A)

Q34: The basic purpose of the securities laws

Q37: Opportunity costs include those cash inflows that

Q81: Weiss Inc.arranged a $10,000,000 revolving credit agreement

Q96: If the inflation rate in the United

Q105: Data on Shin Inc for last year

Q108: The three alternative current asset investment policies