Exhibit 8A.1

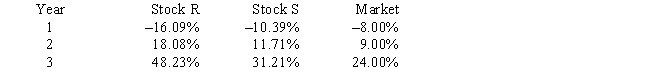

You have been asked to use a CAPM analysis to choose between Stocks R and S,with your choice being the one whose expected rate of return exceeds its required return by the widest margin.The risk-free rate is 5.00%,and the required return on an average stock (or the "market") is 9.00%.Your security analyst tells you that Stock S's expected rate of return is equal to 12.00%,while Stock R's expected rate of return is equal to 14.00%.The CAPM is assumed to be a valid method for selecting stocks,but the expected return for any given investor (such as you) can differ from the required rate of return for a given stock.The following past rates of return are to be used to calculate the two stocks' beta coefficients,which are then to be used to determine the stocks' required rates of return:

Note: The averages of the historical returns are not needed,and they are generally not equal to the expected future returns.

-Refer to Exhibit 8A.1.Set up the SML equation and use it to calculate both stocks' required rates of return,and compare those required returns with the expected returns given above.You should invest in the stock whose expected return exceeds its required return by the widest margin.What is the widest positive margin,or greatest excess return (expected return − required return) ?

Definitions:

Wilhelm Wundt

A German psychologist who is considered the father of experimental psychology, having established the first psychology laboratory.

Psychological Laboratory

A controlled environment where experiments related to psychology and human behavior are conducted to study various psychological phenomena.

Germany

A country in Central Europe known for its rich history, cultural heritage, and significant contributions to art, science, and philosophy.

Phrenology

A now-discredited theory and practice that claimed to determine personality, mental traits, and character by the shape of the skull.

Q2: Discuss the four types of income defined

Q2: D.Paul Inc.forecasts a capital budget of $775,000.The

Q7: Define working capital.

Q10: The SFAS No 157 FASB ASC 820)fair

Q17: What theory on the outcomes of providing

Q18: Net cash provided used)by operating activities −

Q30: Which of the following is not a

Q46: The cost of capital may be different

Q65: The United States and most other major

Q75: Zarruk Construction's DSO is 50 days (on