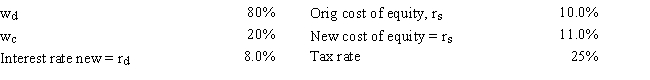

Gator Fabrics Inc.currently has zero debt .It is a zero growth company,and additional firm data are shown below.Now the company is considering using some debt,moving to the new capital structure indicated below.The money raised would be used to repurchase stock at the current price.It is estimated that the increase in risk resulting from the additional leverage would cause the required rate of return on equity to rise somewhat,as indicated below.If this plan were carried out,by how much would the WACC change,i.e. ,what is WACCOld - WACCNew? Do not round your intermediate calculations.

Definitions:

Near-Death Experience

A profound psychological event that may occur to a person close to death or in situations of extreme physical or emotional stress, characterized by experiences such as light at the end of a tunnel, feelings of detachment from the body, feelings of peace, etc.

LSD

LSD, or lysergic acid diethylamide, is a powerful hallucinogenic drug known for altering perception and mood.

Mild Hallucinogen

A substance that induces subtle alterations in perception, mood, and thought, without causing intense hallucinations or loss of reality.

AIDS

Acquired Immune Deficiency Syndrome, a critical illness triggered by the human immunodeficiency virus (HIV) that drastically impairs the immune system.

Q6: Accruals are "spontaneous" funds arising automatically from

Q30: Suppose 90-day investments in Britain have a

Q33: Different borrowers have different risks of bankruptcy,and

Q53: Other things held constant,an increase in financial

Q63: Projects C and D are mutually exclusive

Q69: Porter Inc's stock has an expected return

Q71: A currency trader observes the following quotes

Q77: When considering the risk of a foreign

Q78: If expectations for long-term inflation rose,but the

Q93: Bob has a $50,000 stock portfolio with