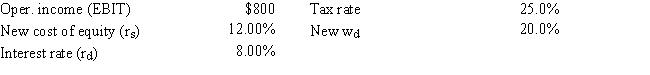

As a consultant to First Responder Inc. ,you have obtained the following data (dollars in millions) .The company plans to pay out all of its earnings as dividends,hence g = 0.Also,no net new investment in operating capital is needed because growth is zero.The CFO believes that a move from zero debt to 20.0% debt would cause the cost of equity to increase from 10.0% to 12.0%,and the interest rate on the new debt would be 8.0%.What would the firm's total market value be if it makes this change? Hints: Find the FCF,which is equal to NOPAT = EBIT(1 - T) because no new operating capital is needed,and then divide by (WACC - g) .Do not round your intermediate calculations.

Definitions:

Competitive Advantages

The attributes that allow an organization to outperform its competitors, including cost structure, product offerings, brand, and customer service.

Sustainable Competitive Advantage

A long-term, defendable position a company holds over competitors, often through unique resources, capabilities, or technologies.

Transferable

Referring to skills, knowledge, or qualities that can be applied in different roles or contexts.

Tangible

Something that is capable of being touched or perceived through the sense of touch; concrete rather than conceptual.

Q2: Given the following returns on Stock J

Q3: U.S.Delay Corporation,a subsidiary of the Postal Service,must

Q11: Susmel Inc.is considering a project that has

Q13: Which of the following statements is CORRECT?<br>A)

Q28: A conflict will exist between the NPV

Q30: Other things held constant,the lower a firm's

Q32: If one U.S.dollar buys 0.67 euro,how many

Q53: Multinational financial management requires that<br>A) the effects

Q58: Based on the corporate valuation model,the total

Q59: Multinational financial management requires that financial analysts