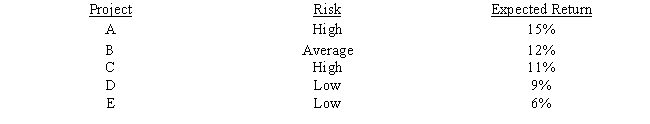

Langston Labs has an overall (composite) WACC of 10%,which reflects the cost of capital for its average asset.Its assets vary widely in risk,and Langston evaluates low-risk projects with a WACC of 8%,average-risk projects at 10%,and high-risk projects at 12%.The company is considering the following projects:

Which set of projects would maximize shareholder wealth?

Which set of projects would maximize shareholder wealth?

Definitions:

Principal

An individual or entity that authorizes an agent to act on their behalf in legal or financial matters.

NPV Criterion

A financial metric used to assess the profitability of an investment, calculating the net present value of all cash flows associated with it.

Future Cash Flows

Estimates of the amount of money expected to be received or paid out in the future through investment, business operations, or other financial activities.

Investment

The act of allocating resources, typically money, with the expectation of generating an income or profit.

Q4: Mooradian Corporation's free cash flow during the

Q8: Which of the following statements is CORRECT?

Q22: Suppose Tapley Inc.uses a WACC of 8%

Q25: Modigliani and Miller's second article,which assumed the

Q33: Other things held constant,which of the following

Q40: If a firm's projects differ in risk,then

Q43: Suppose 6 months ago a Swiss investor

Q62: Which of the following statements is CORRECT?

Q71: A currency trader observes the following quotes

Q74: You are considering 2 bonds that will