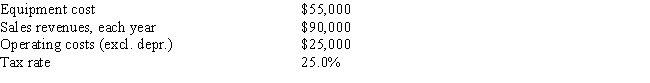

Fool Proof Software is considering a new project whose data are shown below.The equipment that would be used has a 3-year tax life.Under the new tax law,the equipment used in the project is eligible for 100% bonus depreciation,so it will be fully depreciated at t = 0.Revenues and operating costs are expected to be constant over the project's 10-year expected life.What is the Year 1 cash flow?

Definitions:

Formation Of Contract

The legal process by which an agreement between parties becomes legally enforceable, usually involving offer, acceptance, consideration, and mutual intent.

Offer And Acceptance

The fundamental components of a contract where one party makes an offer and the other accepts, creating a legally binding agreement.

Consideration

A value (such as money, service, or goods) exchanged between parties in a contract, making the agreement legally binding.

Fairness

The quality of being impartial, just, and equitable in decisions and actions.

Q3: Which of the following statements is CORRECT?<br>A)

Q3: An increase in any current asset must

Q5: For a typical firm,which of the following

Q10: If the yield curve is upward sloping,then

Q14: Which of the following statements is CORRECT?<br>A)

Q30: Which of the following is NOT a

Q39: Stock A has a beta of 0.8

Q44: Which of the following bonds would have

Q86: If a firm switched from taking trade

Q96: Which of the following statements is CORRECT?<br>A)