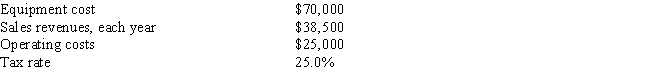

Your company,CSUS Inc. ,is considering a new project whose data are shown below.The required equipment has a 3-year tax life.Under the new law,the equipment used in the project is eligible for 100% bonus depreciation,so the equipment will be fully depreciated at t = 0.The equipment has no salvage value at the end of the project's life,and the project does not require any additional operating working capital.Revenues and operating costs are expected to be constant over the project's 10-year expected operating life.What is the project's Year 4 cash flow?

Definitions:

Ciliated

Relating to or having tiny hair-like structures on the surface that move in a wavelike manner to propel substances.

Smooth Muscle

A type of muscle found in the walls of internal organs and blood vessels, functioning involuntarily to regulate bodily processes.

Bronchioles

Small airways in the lungs that branch off from the bronchi, leading to the alveoli where gas exchange occurs.

Ciliary Action

The movement of cilia, small hair-like structures, to move particles or fluid over their surface, commonly seen in respiratory and reproductive tracts.

Q3: An increase in any current asset must

Q6: Which of the following statements is CORRECT?<br>A)

Q11: You work for Whittenerg Inc. ,which is

Q16: Which of the following should be considered

Q51: Roton Inc.purchases merchandise on terms of 2/15,net

Q69: The corporate valuation model cannot be used

Q73: Immediate expensing of depreciation has an advantage

Q75: Which of the following statements is CORRECT?<br>A)

Q90: Singal Inc.is preparing its cash budget.It expects

Q120: On average,a firm collects checks totaling $250,000