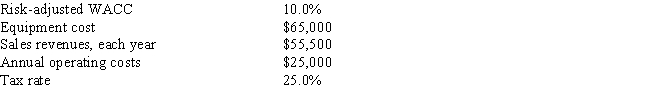

Temple Corp.is considering a new project whose data are shown below.The equipment that would be used has a 3-year tax life.Under the new tax law,the equipment used in the project is eligible for 100% bonus depreciation,so it will be fully depreciated at t = 0.The equipment would have a zero salvage value at the end of the project's life.No change in net operating working capital (NOWC) would be required.Revenues and operating costs are expected to be constant over the project's 3-year life.What is the project's NPV? Do not round the intermediate calculations and round the final answer to the nearest whole number.

Definitions:

Financial Statement

Documents that present an organization's financial performance and position, including the balance sheet, income statement, and cash flow statement.

Normal Balance

The part of an account, whether debit or credit, that is used to log increases in the account's value.

Account Nature

Refers to the classification of an account as either an asset, liability, equity, revenue, or expense.

Recorded Voucher

A documented voucher that has been entered into a financial accounting system.

Q3: Your portfolio consists of $50,000 invested in

Q5: In 1985,a given Japanese imported automobile sold

Q9: Sorensen Systems Inc.is expected to pay a

Q16: If a stock's dividend is expected to

Q17: An informal line of credit and a

Q31: Gray Manufacturing is expected to pay a

Q54: A firm that bases its capital budgeting

Q81: Weiss Inc.arranged a $10,000,000 revolving credit agreement

Q88: You must estimate the intrinsic value of

Q96: Helena Furnishings wants to reduce its cash