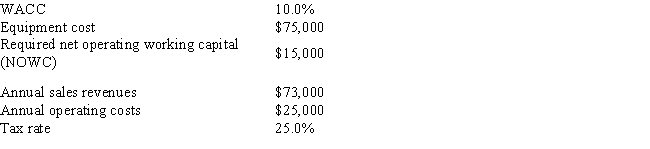

Foley Systems is considering a new project whose data are shown below.Under the new tax law,the equipment for the project is eligible for 100% bonus depreciation,so it will be fully depreciated at t = 0.After the project's 3-year life,the equipment would have zero salvage value.The project would require additional net operating working capital (NOWC) that would be recovered at the end of the project's life.Revenues and operating costs are expected to be constant over the project's life.What is the project's NPV? (Hint: Cash flows from operations are constant in Years 1 to 3. ) Do not round the intermediate calculations and round the final answer to the nearest whole number.

Definitions:

Fixed Manufacturing Overhead

Expenses in a manufacturing process that remain constant regardless of the level of production, including costs like factory lease payments and equipment maintenance.

Cash Account

An account recording all cash transactions, including receipts and payments, reflecting the liquidity of a business.

Standard Cost System

An accounting method that uses predetermined costs for product costing, budgeting, and inventory valuation purposes.

Work in Process

Items that are in the process of being produced but are not yet completed in a manufacturing setting.

Q5: From an investor's perspective,a firm's preferred stock

Q8: Chua Chang & Wu Inc.is planning its

Q16: Which of the following statements is CORRECT?<br>A)

Q37: A foreign currency will,on average,depreciate against the

Q55: Suppose Walker Publishing Company is considering bringing

Q55: Which of the following statements is CORRECT?<br>A)

Q63: Kale Inc.forecasts the free cash flows (in

Q68: The Modigliani and Miller (MM)articles implicitly assumed,among

Q101: A stock's beta measures its diversifiable risk

Q116: Which of the following statements is CORRECT?<br>A)