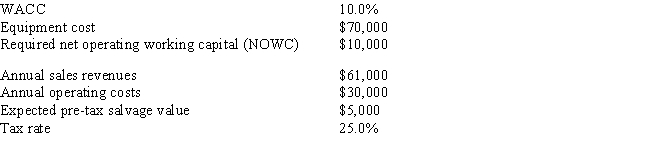

Thomson Media is considering some new equipment whose data are shown below.The equipment has a 3-year tax life.Under the new tax law,the equipment is eligible for 100% bonus depreciation,so it will be fully depreciated at t = 0.The equipment would have a positive pre-tax salvage value at the end of Year 3,when the project would be closed down.Also,additional net operating working capital (NOWC) would be required,but it would be recovered at the end of the project's life.Revenues and operating costs are expected to be constant over the project's 3-year life.What is the project's NPV? Do not round the intermediate calculations and round the final answer to the nearest whole number.

Definitions:

Q38: "Capital" is sometimes defined as funds supplied

Q42: If on January 3 a company declares

Q50: Which of the following statements is CORRECT?<br>A)

Q54: If an investor can obtain more of

Q59: Bond X has an 8% annual coupon,Bond

Q71: Schalheim Sisters Inc.has always paid out all

Q84: The price sensitivity of a bond to

Q84: El Capitan Foods has a capital structure

Q109: The maturity matching,or "self-liquidating",approach to financing involves

Q146: The CAPM is built on historic conditions,although