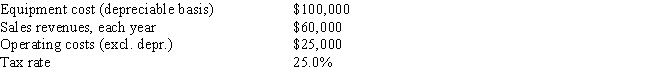

Clemson Software is considering a new project whose data are shown below.The required equipment has a 3-year tax life,after which it will be worthless.Under the new tax law,the equipment is eligible for 100% bonus depreciation,so it will be fully depreciated at t = 0.Revenues and operating costs are expected to be constant over the project's 3-year life.What is the project's Year 1 cash flow? Do not round the intermediate calculations and round the final answer to the nearest whole number.

Definitions:

Probability .70

A statistical measure indicating a 70% chance of a specified event occurring.

Nash Equilibrium

A situation in a non-cooperative game where each player's strategy is optimal given the strategies of all other players.

Press Button

An act of pressing a switch or a button to control a machine or process.

Big Pig

This term does not match a standard economic concept and might be context-specific or refer to a specific case or study. NO.

Q5: Liberty Services is now at the end

Q13: Which of the following statements is CORRECT?<br>A)

Q30: Mid-State BankCorp recently declared a 7-for-2 stock

Q32: If one U.S.dollar buys 0.67 euro,how many

Q58: The cost of perpetual preferred stock is

Q68: The Modigliani and Miller (MM)articles implicitly assumed,among

Q78: If a firm takes actions that reduce

Q78: A 10-year Treasury bond has an 8%

Q79: Founders' shares,a type of classified stock owned

Q95: Shorter-term cash budgets (such as a daily