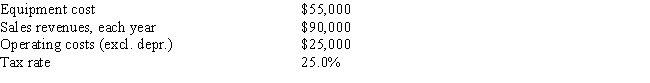

Fool Proof Software is considering a new project whose data are shown below.The equipment that would be used has a 3-year tax life.Under the new tax law,the equipment used in the project is eligible for 100% bonus depreciation,so it will be fully depreciated at t = 0.Revenues and operating costs are expected to be constant over the project's 10-year expected life.What is the Year 1 cash flow?

Definitions:

Fair Deal

An agreement or transaction that is considered equitable and just to all parties involved.

True Objections

Genuine concerns or issues raised by a prospect that can potentially block a sale, requiring direct attention and resolution.

Technology Integration

The coherent incorporation of technological tools into a business, educational setting, or daily activities to enhance functionality and efficiency.

Closing Sales

The final step in the sales process where the seller successfully secures a commitment to purchase from the buyer.

Q1: Which of the following statements is most

Q1: If markets are in equilibrium,which of the

Q17: Consider the following information and then calculate

Q35: Superior analytical techniques,such as NPV,used in combination

Q36: S.Bouchard and Company hired you as a

Q45: Under certain conditions,a project may have more

Q53: The standard deviation is a better measure

Q55: Which of the following is NOT commonly

Q97: Gonzales Company currently uses maximum trade credit

Q98: Assume that you are the portfolio manager