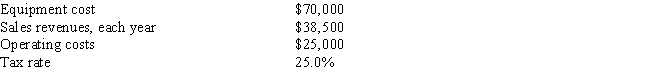

Your company,CSUS Inc. ,is considering a new project whose data are shown below.The required equipment has a 3-year tax life.Under the new law,the equipment used in the project is eligible for 100% bonus depreciation,so the equipment will be fully depreciated at t = 0.The equipment has no salvage value at the end of the project's life,and the project does not require any additional operating working capital.Revenues and operating costs are expected to be constant over the project's 10-year expected operating life.What is the project's Year 4 cash flow?

Definitions:

Social Responsibility

The ethical framework suggesting that an individual or organization has an obligation to act for the benefit of society at large.

Compound

A substance formed when two or more chemical elements are chemically bonded together.

Simple

Easy to understand or do; not complicated.

Q14: Stocks X and Y have the following

Q24: Purcell Farms Inc.has the following data,and it

Q58: Suppose one year ago,Hein Company had inventory

Q69: Porter Inc's stock has an expected return

Q83: Projects S and L both have normal

Q88: Your company,which is financed entirely with common

Q92: The prices of high-coupon bonds tend to

Q132: Bad managerial judgments or unforeseen negative events

Q138: Kollo Enterprises has a beta of 1.02,the

Q139: The distributions of rates of return for