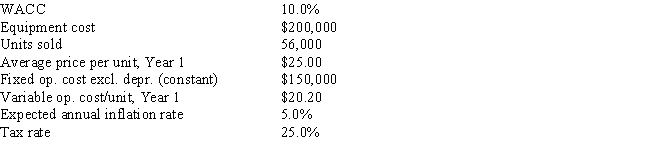

Desai Industries is analyzing an average-risk project,and the following data have been developed.Unit sales will be constant,but the sales price should increase with inflation.Fixed costs will also be constant,but variable costs should rise with inflation.The project should last for 3 years.Under the new tax law,the equipment used in the project is eligible for 100% bonus depreciation,so it will be fully depreciated at t = 0.At the end of the project's life,the equipment would have no salvage value.No change in net operating working capital (NOWC) would be required for the project.This is just one of many projects for the firm,so any losses on this project can be used to offset gains on other firm projects.What is the project's expected NPV? Do not round the intermediate calculations and round the final answer to the nearest whole number.

Definitions:

Speak Fluently

The capability to express oneself easily and articulately in spoken language.

Middle Childhood

A developmental stage that typically covers the period from around six to twelve years of age, characterized by significant growth in cognitive, emotional, and social abilities.

Growth Patterns

The tendencies or trends in physical or psychological development observed over time in individuals or groups.

Sex Differences

Variations between males and females that can be attributed to biological and physiological factors.

Q1: Firms HD and LD are identical except

Q18: Which of the following is NOT a

Q23: The relative risk of a proposed project

Q61: Cass & Company has the following data.What

Q62: Agarwal Technologies was founded 10 years ago.It

Q65: Which one of the following would NOT

Q66: Which of the following statements is CORRECT?<br>A)

Q84: A proxy is a document giving one

Q101: A stock's beta measures its diversifiable risk

Q143: Nagel Equipment has a beta of 0.88