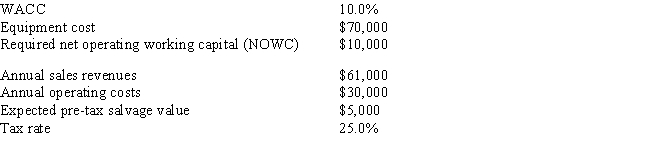

Thomson Media is considering some new equipment whose data are shown below.The equipment has a 3-year tax life.Under the new tax law,the equipment is eligible for 100% bonus depreciation,so it will be fully depreciated at t = 0.The equipment would have a positive pre-tax salvage value at the end of Year 3,when the project would be closed down.Also,additional net operating working capital (NOWC) would be required,but it would be recovered at the end of the project's life.Revenues and operating costs are expected to be constant over the project's 3-year life.What is the project's NPV? Do not round the intermediate calculations and round the final answer to the nearest whole number.

Definitions:

Out-Of-Pocket Expenditures

Expenses for medical care that aren't reimbursed by insurance and are paid directly by the patient.

Patient Protection

Legal and ethical measures and policies designed to safeguard patients' rights, privacy, and well-being in healthcare settings.

Affordable Care Act

A comprehensive healthcare reform law enacted in 2010 in the United States, aimed at increasing health insurance coverage and reducing healthcare costs.

Part-Time Employees

Workers who are employed for fewer hours than the full-time standard, often receiving reduced benefits and compensation.

Q3: Cranberry Corp.has two divisions of equal size:

Q6: Accruals are "spontaneous" funds arising automatically from

Q13: It has been argued that investors prefer

Q34: A zero coupon bond is a bond

Q35: For a stock to be in equilibrium,two

Q41: Stock X has a beta of 0.6,while

Q43: When adding a randomly chosen new stock

Q61: Both the regular and the modified IRR

Q68: The Modigliani and Miller (MM)articles implicitly assumed,among

Q77: Norris Enterprises,an all-equity firm,has a beta of