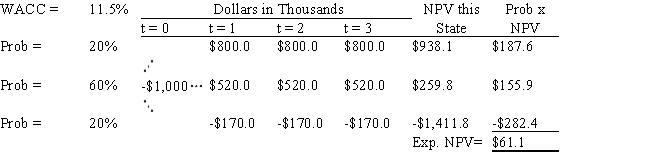

Aggarwal Enterprises is considering a new project that has an initial cash outflow of $1,000,000,and the CFO set up the following simple decision tree to show its three most-likely scenarios.The firm could arrange with its work force and suppliers to cease operations at the end of Year 1 should it choose to do so,but to obtain this abandonment option,it would have to make a payment to those parties.How much is the option to abandon worth (in thousands of dollars) to the firm? Do not round the intermediate calculations.

Definitions:

Turnover

The rate at which inventory or assets of a business are replaced or sales are made over a specific period.

Margin

Generally refers to the difference between the selling price of a good or service and its cost, expressed as a percentage of the selling price.

Residual Income

The income that remains after deducting all required costs of capital from operating income, used as a measure of profitability.

Margin

Margin refers to the difference between the selling price of a good or service and its cost of production, usually expressed as a percentage of the selling price.

Q3: Your portfolio consists of $50,000 invested in

Q5: Last year Wei Guan Inc.had $275 million

Q10: Last year Godinho Corp.had $320 million of

Q21: Other things held constant,if the expected inflation

Q66: The preemptive right is important to shareholders

Q72: If a retired individual lives on his

Q89: Refer to Exhibit 10.1.Which of the following

Q92: The prices of high-coupon bonds tend to

Q106: The NPV and IRR methods,when used to

Q122: Since depreciation is a non-cash charge,it neither