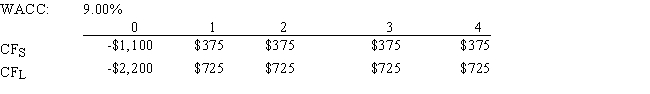

Nast Inc.is considering Projects S and L,whose cash flows are shown below.These projects are mutually exclusive,equally risky,and not repeatable.If the decision is made by choosing the project with the higher MIRR rather than the one with the higher NPV,how much value will be forgone? Note that under some conditions choosing projects on the basis of the MIRR will cause $0.00 value to be lost.

Definitions:

Local Service

A service provided within a limited geographic area, typically catering to the needs of a community or specific locality.

Self-Control

Restraint exercised over one’s own impulses, desires, or emotions; temperance.

Ignore Conscience

Choosing to act without regard to one's internal sense of right and wrong.

Art And Science

A phrase indicating a blend of creativity and systematic study in a discipline, implying that both intuitive and analytical approaches are valuable.

Q4: Since 70% of the preferred dividends received

Q18: The text identifies three methods for estimating

Q20: Morin Company's bonds mature in 8 years,have

Q33: If D<sub>0</sub> = $1.75,g (which is constant)=

Q41: Because the maturity risk premium is normally

Q48: Several years ago the Jakob Company sold

Q49: Assume that a noncallable 10-year T-bond has

Q79: You hold a diversified $100,000 portfolio consisting

Q83: The cost of debt is equal to

Q137: Stock A has a beta of 1.2