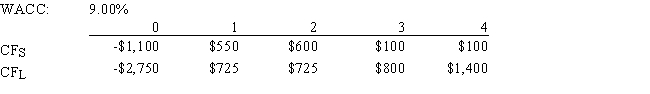

Noe Drilling Inc.is considering Projects S and L,whose cash flows are shown below.These projects are mutually exclusive,equally risky,and not repeatable.The CEO believes the IRR is the best selection criterion,while the CFO advocates the MIRR.If the decision is made by choosing the project with the higher IRR rather than the one with the higher MIRR,how much,if any,value will be forgone,i.e. ,what's the NPV of the chosen project versus the maximum possible NPV? Note that (1) "true value" is measured by NPV,and (2) under some conditions the choice of IRR vs.MIRR will have no effect on the value lost.

Definitions:

Responsiveness

The quality of reacting quickly and positively to changes or stimuli.

Still-face Technique

A research experiment where a caregiver maintains a neutral, unresponsive face towards an infant, observing the child's response to the lack of social engagement.

Emotional Reaction

An individual's immediate and instinctive response to a situation or event, often influenced by personal experiences and temperament.

Facial Expressions

The movements and positions of the face that convey emotional states or reactions to stimuli.

Q29: Companies can issue different classes of common

Q35: According to Modigliani and Miller (MM),in a

Q39: Which of the following statements is CORRECT?<br>A)

Q41: Because the maturity risk premium is normally

Q53: Stern Associates is considering a project that

Q57: Other things held constant,if a firm "stretches"

Q71: Which of the following statements is NOT

Q72: Suppose you hold a portfolio consisting of

Q111: For a portfolio of 40 randomly selected

Q144: Assume that the risk-free rate is 5%.Which