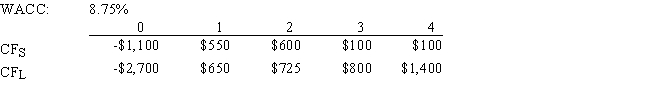

Tesar Chemicals is considering Projects S and L,whose cash flows are shown below.These projects are mutually exclusive,equally risky,and not repeatable.The CEO believes the IRR is the best selection criterion,while the CFO advocates the NPV.If the decision is made by choosing the project with the higher IRR rather than the one with the higher NPV,how much,if any,value will be forgone,i.e. ,what's the chosen NPV versus the maximum possible NPV? Note that (1) "true value" is measured by NPV,and (2) under some conditions the choice of IRR vs.NPV will have no effect on the value gained or lost.

Definitions:

Chi-Square

A statistical test used to determine if a significant relationship exists between two categorical variables in a contingency table.

Degrees of Freedom (df)

Number of values or quantities free to vary when a statistic is used to estimate a parameter.

Expected Frequency

In statistics, the frequency expected in a category of a contingency table under the assumption that the null hypothesis is true.

Chi-Square

A statistical test that measures the difference between observed and expected frequencies in categorical data.

Q3: In the foreseeable future,the real risk-free rate

Q5: Last year Wei Guan Inc.had $275 million

Q14: If a firm's capital intensity ratio (A<sup>*</sup>/S<sub>0</sub>)decreases

Q15: Last year Handorf-Zhu Inc.had $850 million of

Q16: The slope of the SML is determined

Q24: There is an inverse relationship between bonds'

Q37: Based on the information below,what is the

Q45: Taggart Inc.'s stock has a 50% chance

Q92: A firm's collection policy,i.e. ,the procedures it

Q124: "Risk aversion" implies that investors require higher