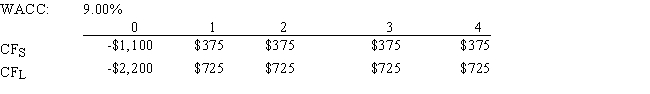

Nast Inc.is considering Projects S and L,whose cash flows are shown below.These projects are mutually exclusive,equally risky,and not repeatable.If the decision is made by choosing the project with the higher MIRR rather than the one with the higher NPV,how much value will be forgone? Note that under some conditions choosing projects on the basis of the MIRR will cause $0.00 value to be lost.

Definitions:

Financial Information

Data concerning a person's or organization's monetary transactions, assets, liabilities, revenue, expenses, and financial performance.

Immunization Record

A documentation of all the vaccines a person has received, serving as a health record to track immunization status.

Previous Provider

The healthcare professional or facility from whom a patient has received treatment in the past.

Physician's Order

Specific instructions for patient care, prescribed by a physician, that can include medications, tests, diets, or therapies.

Q15: The four most fundamental factors that affect

Q17: Suppose the real risk-free rate is 2.50%

Q34: A zero coupon bond is a bond

Q39: Which of the following statements is CORRECT?

Q41: Because "present value" refers to the value

Q56: There are two types of dividend reinvestment

Q69: Which of the following is NOT directly

Q71: If the Treasury yield curve were downward

Q73: An upward-sloping yield curve is often call

Q97: For a project with one initial cash