Exhibit 10.1

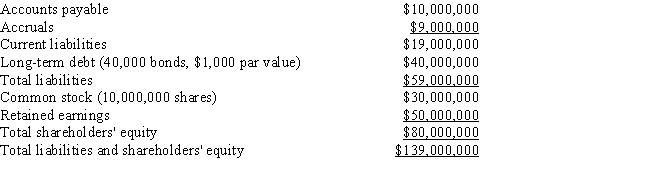

Assume that you have been hired as a consultant by CGT,a major producer of chemicals and plastics,including plastic grocery bags,styrofoam cups,and fertilizers,to estimate the firm's weighted average cost of capital.The balance sheet and some other information are provided below.

Assets

Liabilities and Equity

Liabilities and Equity

The stock is currently selling for $15.25 per share,and its noncallable $1,000.00 par value,20-year,9.00% bonds with semiannual payments are selling for $930.41.The beta is 1.22,the yield on a 6-month Treasury bill is 3.50%,and the yield on a 20-year Treasury bond is 5.50%.The required return on the stock market is 11.50%,but the market has had an average annual return of 14.50% during the past 5 years.The firm's tax rate is 25%.

-Refer to Exhibit 10.1.Based on the CAPM,what is the firm's cost of equity?

Definitions:

Utility Function

A mathematical representation that describes how the total utility of a consumer depends on the consumption of various goods and services.

Budget Line

A visual depiction of every potential pair of two products a consumer is able to buy based on their earnings and the costs of these items.

Utility Function

A mathematical representation of how different quantities of goods or services translate into levels of happiness or satisfaction for an individual or society.

Utility Function

A mathematical representation that assigns a value to every possible choice to indicate the level of satisfaction or utility that choice provides to a consumer.

Q7: Assuming all else is constant,which of the

Q25: If investors expect the rate of inflation

Q25: Modigliani and Miller's second article,which assumed the

Q28: Changes in net operating working capital should

Q29: Miller and Modigliani's dividend irrelevance theory says

Q33: As a result of compounding,the effective annual

Q33: The before-tax cost of debt,which is lower

Q62: If a firm uses the residual dividend

Q68: The real risk-free rate is expected to

Q97: Gonzales Company currently uses maximum trade credit