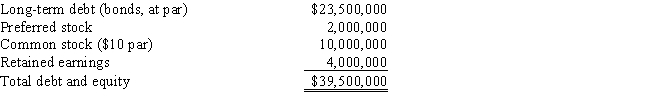

In order to accurately assess the capital structure of a firm,it is necessary to convert its balance sheet figures from historical book values to market values.KJM Corporation's balance sheet (book values) as of today is as follows:  The bonds have a 8.4% coupon rate,payable semiannually,and a par value of $1,000.They mature exactly 10 years from today.The yield to maturity is 11%,so the bonds now sell below par.What is the current market value of the firm's debt?

The bonds have a 8.4% coupon rate,payable semiannually,and a par value of $1,000.They mature exactly 10 years from today.The yield to maturity is 11%,so the bonds now sell below par.What is the current market value of the firm's debt?

Definitions:

Investing Activities

Transactions involving the purchase and sale of long-term assets and other investments not considered cash equivalents.

Net Cash

The amount of cash remaining after all operating, investing, and financing activities have been accounted for over a specific period.

Investing Activities

Transactions related to the acquisition or sale of long-term assets and investments.

Noncurrent Assets

Assets intended for long-term use and not expected to be converted into cash within one year, such as equipment, real estate, and patents.

Q2: Carson Inc.'s manager believes that economic conditions

Q25: Over the years,O'Brien Corporation's stockholders have provided

Q31: Which of the following statements is CORRECT?<br>A)

Q42: Refer to Exhibit 10.1.What is the best

Q46: In general,firms should use their weighted average

Q47: Rao Construction recently reported $30.00 million of

Q52: The realized return on a stock portfolio

Q65: For a stock to be in equilibrium-that

Q82: Suppose the U.S.Treasury offers to sell you

Q152: Suppose a U.S.treasury bond will pay $4,475