Use the following information and the percentage-of-sales method to answer the following question(s) .

Below is the 2017 year-end balance sheet for Richmond Enterprises.Sales for 2017 were $1 600,000 and are expected to be $2 000,000 during 2018.In addition, we know that Banner plans to pay $90,000 in 2018 dividends and expects projected net income of 4% of sales.(For consistency with the answer selections provided, round your forecast percentages to two decimals.)

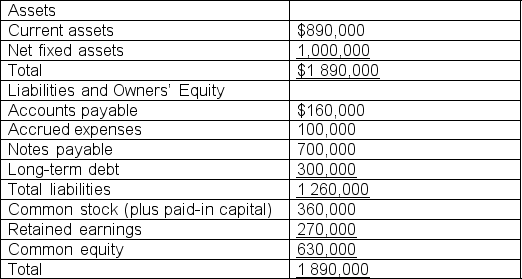

Richmond Enterprises Balance Sheet

December 31, 2017

-Richmond's projected accrued expenses for 2018 are

Definitions:

Excise Tax

A tax applied on specific goods, such as tobacco and alcohol, usually to discourage their use or raise government revenue.

Excise Tax

A tax charged on specific goods and services, such as alcohol, tobacco, and gasoline, usually to discourage their use or generate revenue.

Equilibrium Price

The price in a competitive market at which the quantity demanded and the quantity supplied are equal, there is neither a shortage nor a surplus, and there is no tendency for price to rise or fall.

Federal Income Tax

Federal income tax is the tax levied by the national government on individuals and organizations' annual earnings.

Q21: Based on the information in Table 1,

Q25: If a firm chose to increase its

Q37: Hayes Market's Total Assets = $25 million.The

Q38: [blank] is a contract wherein a price

Q44: Which of the following cash flows should

Q56: A reverse share split, 1 for 10

Q86: If revenues can be forecast to fall

Q97: The difference between a stock's current price

Q120: Unexpected dividend changes would cause investors to

Q124: Which of the following must be adjusted