Use the following information to answer the following question(s) .

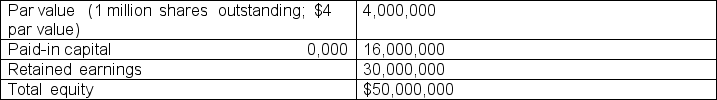

Your firm is planning to pay a 15% share dividend.The market price for the share has been $84.The table below presents the equity portion of your firm's balance sheet before the dividend.

Common share

-Five years ago, Ms.Lopez purchased 1000 shares of JPM stock at $50 per share.The market price of the share is now $55.If Ms.Lopez' tax rate is 25%, would she prefer that the company pay a $5.00 per share dividend or offer to repurchase 100 shares at the market price? Assume that after the ex-dividend date, the price would return to $50 per share, but a share repurchase would not affect the market price.

Definitions:

Incidental Damages

Incidental damages refer to the costs incurred by one party due to another's breach of contract, including expenses directly resulting from the breach, such as costs to find a replacement.

Installment Contract

A contractual arrangement where payment is made in parts over a period of time until the full purchase price is paid.

CISG

Stands for the United Nations Convention on Contracts for the International Sale of Goods, which governs the sale of goods between businesses in different countries.

Avoidance

A legal principle or action taken to invalidate or cancel a contract, thereby relieving the parties of their obligations under that contract.

Q5: What are the differences between forward contracts

Q8: Assuming an after-tax cost of preference share

Q11: As the risk free rate of return

Q30: How does the text distinguish between firm's

Q35: [blank] is a risk analysis technique in

Q47: Book values are sometimes used to calculate

Q48: Michael believes that if he can make

Q65: Grove Pretzel is replacing an old pretzel

Q72: Maymill Company's share is trading ex-dividend at

Q83: Jefferson & Co.is considering adding a product