Use the following information to answer the following question.

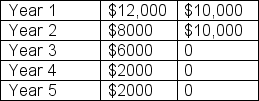

Below are the expected after-tax cash flows for Projects Y and Z.Both projects have an initial cash outlay of $20,000 and a required rate of return of 17%.

Project Y Project Z

-MacHinery Manufacturing Company is considering a three-year project that has a cost of $75,000.The project will generate after-tax cash flows of $33,100 in year 1, $31,500 in year 2, and $31,200 in year 3.Assume that the firm's proper rate of discount is 10% and that the firm's tax rate is 40%.What is the project's payback period?

Definitions:

Normal Good

A good for which an increase in income raises the quantity demanded.

Inferior Good

A type of good for which demand decreases as the income of consumers increase, unlike normal goods for which demand increases with an increase in income.

Income Decrease

Income decrease refers to a reduction in the amount of money earned by an individual or received by a household, affecting their ability to spend and save.

Giffen Goods

A type of product that paradoxically experiences increased demand as its price rises, seemingly contrary to the basic law of demand due to the effect on consumption of essential goods.

Q3: The expected rate of return on a

Q3: An emerging market is [blank].<br>A)a market for

Q20: Which of the following statements is true?<br>A)A

Q29: Risk-adjusted discount rate is based on the

Q31: An investor will get maximum risk reduction

Q31: Even though an investor expects a positive

Q45: Discounted payback periods for projects Y and

Q46: A portfolio will always have less risk

Q47: Pixie Ltd just paid a $2.00 dividend

Q63: The market risk premium is [blank].<br>A)2%<br>B)4%<br>C)6%<br>D)8%