Use the following information to answer the following question.

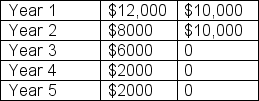

Below are the expected after-tax cash flows for Projects Y and Z.Both projects have an initial cash outlay of $20,000 and a required rate of return of 17%.

Project Y Project Z

-MacHinery Manufacturing Company is considering a three-year project that has a cost of $75,000.The project will generate after-tax cash flows of $33,100 in year 1, $31,500 in year 2, and $31,200 in year 3.Assume that the appropriate discount rate is 10% and that the firm's tax rate is 40%.What is the project's discounted payback period?

Definitions:

Interest Payment

The amount paid by a borrower to a lender as compensation for the use of borrowed money, usually expressed as a percentage of the principal.

Interest Expense

Financial obligations an entity must fulfill for using borrowed money over time.

Issued

Refers to the process whereby a company distributes shares to shareholders, which can include both the initial offering to the public and subsequent offerings.

Premium

An additional amount paid over the normal cost, often associated with insurance or bonds.

Q1: Scenario analysis is the form of risk

Q6: Firm B's risk premium is [blank].<br>A)2.66%<br>B)4.8%<br>C)6.3%<br>D)8.1%

Q16: If the NPV of a project is

Q19: If Untel Inc.decides to manufacture a new

Q20: Kahnemann Kookies is evaluating the replacement of

Q43: What is meant by the terms "favourable"

Q51: When Starbucks decided to acquire Seattle's Best

Q56: From the issuing firm's point of view,

Q67: What is the value today of an

Q98: Metals Corp.has $2,575,000 of debt, $550 000