Use the following information to answer the following question.

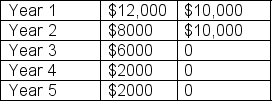

Below are the expected after-tax cash flows for Projects Y and Z.Both projects have an initial cash outlay of $20,000 and a required rate of return of 17%.

Project Y Project Z

-You are considering investing in a project with the following year-end after-tax cash flows: Year 1: $5000

Year 2: $3200

Year 3: $7800

If the initial outlay for the project is $12 113, calculate the project's IRR.

Definitions:

Night Terrors

Relatively rare disorder in which the person experiences extreme fear and screams or runs around during deep sleep without waking fully.

Heroin Addiction

A severe substance use disorder characterized by the compulsive use of heroin, leading to significant health, social, and economic consequences.

Methadone

A synthetic opioid used as a pain reliever and as part of drug addiction detoxification and maintenance programs.

LSD

Lysergic acid diethylamide, a powerful psychoactive drug known for its psychological effects, which can include altered thinking processes and visual hallucinations.

Q9: The Blackburn Group has recently issued 20-year,

Q18: Project Zeta is expected to produce after-tax

Q44: If interest expense lowers taxes, why does

Q48: Rockwell Smoothie is considering a project with

Q56: You are considering investing in a firm

Q70: A bond that is held to maturity

Q75: Which of the following features allows a

Q79: As bond approaches maturity, discounts and premiums

Q87: Betas for individual shares tend to be

Q90: The shareholder's expected rate of return consists