Use the following information to answer the following question.

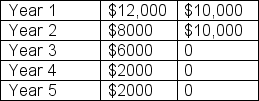

Below are the expected after-tax cash flows for Projects Y and Z.Both projects have an initial cash outlay of $20,000 and a required rate of return of 17%.

Project Y Project Z

-MacHinery Manufacturing Company is considering a three-year project that has a cost of $75,000.The project will generate after-tax cash flows of $33,100 in year 1, $31,500 in year 2, and $31,200 in year 3.Assume that the firm's proper rate of discount is 10% and that the firm's tax rate is 40%.What is the project's payback period?

Definitions:

Depreciation

The reduction in the value of an asset over time due to wear and tear or obsolescence.

Dollar

The basic monetary unit used in the United States and other countries, symbolized by $.

Exports

Goods or services produced in one country and sold to buyers in another country.

Financial Account

Refers to a component of a country's balance of payments that records investments and financial transactions, including investments in foreign securities and direct investments.

Q16: Which of the following is a reasonable

Q21: As a general rule, good investments are

Q27: A firm purchased an asset with a

Q28: Briefly describe the five steps in performing

Q33: Tantasqua Paper Products is composed of three

Q34: What would cause the initial cash outlay

Q56: Given the anticipated rate of inflation (i)of

Q62: Murky Pharmaceuticals has issued preference shares with

Q69: Bond ratings measure the interest rate risk

Q71: You are considering the purchase of AMDEX