Use the following information to answer the following question.

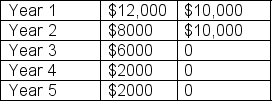

Below are the expected after-tax cash flows for Projects Y and Z.Both projects have an initial cash outlay of $20,000 and a required rate of return of 17%.

Project Y Project Z

-You are considering investing in a project with the following year-end after-tax cash flows: Year 1: $5000

Year 2: $3200

Year 3: $7800

If the initial outlay for the project is $12 113, calculate the project's IRR.

Definitions:

Base Value

A reference point or initial value used in financial calculations, indexes, or for measuring changes in economic indicators.

Missing Value

In data analysis, a data point that is absent or not recorded, which can affect the outcome of statistical models.

Decimal Places

The quantity of numerals located to the right side of the decimal point in a numeric value.

Missing Value

A data term referring to a value that is lost, unrecorded, nonexistent, or omitted in a dataset.

Q5: A project with a positive NPV may

Q6: Charlie Stone wants to retire in 30

Q21: July sales for Amherst Arcade equal $100,000,

Q35: [blank] is a risk analysis technique in

Q36: Under the efficient market hypothesis, would securities

Q63: A decrease in the [blank] will increase

Q99: What is the expected dollar return on

Q109: If you have $375 000 in an

Q111: Which of the following bond types has

Q118: When is a call provision most valuable?