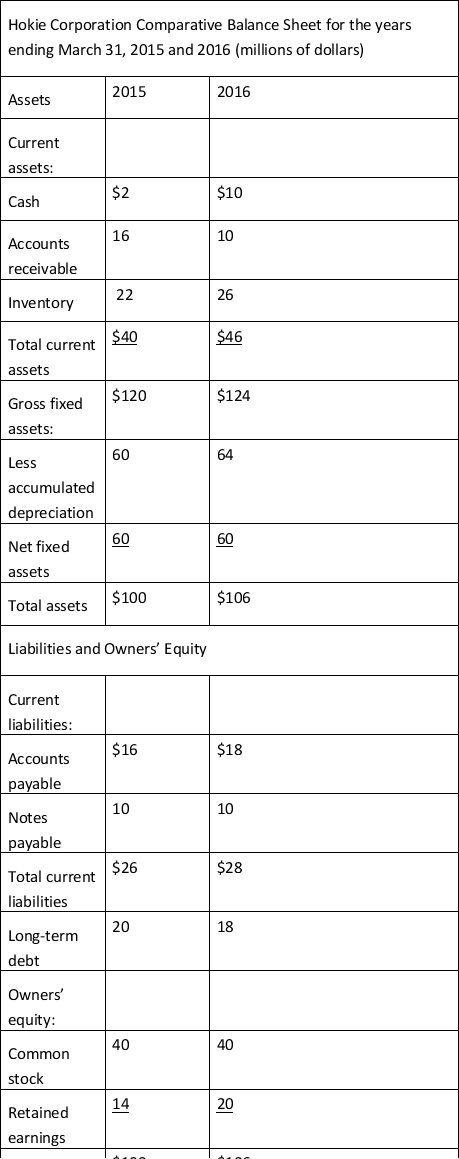

Table 3

Hokie had net profit of $26 million for 1996 and paid total cash dividends of $20 million to their common stockholders.

Hokie had net profit of $26 million for 1996 and paid total cash dividends of $20 million to their common stockholders.

-Calculate the following financial ratios for the Hokie Corporation using the information given in Table 3 and 2016 information.

current ratio

acid-test ratio

debt ratio

long-term debt to total capitalisation

return on total assets

return on common equity

Definitions:

Indirect Method

A financial reporting approach used in cash flow statements to reconcile net income with cash flow from operating activities by adjusting for non-cash transactions.

Goodwill

An intangible asset that arises when a buyer acquires an existing business, representing the premium paid over the fair value of the net identifiable assets.

Voting Stock

Shares that give the stockholder the right to vote on matters of corporate policy making and the election of the board of directors.

Fair Value

The price at which an asset or liability could be exchanged between knowledgeable, willing parties in an arm's length transaction.

Q4: Paper Clip Office Supply had $24 000

Q14: Under current accounting rules, plant and equipment

Q33: In financial markets, borrowers pay savers by

Q42: Business dealings between people and firms ultimately

Q47: If a company has an income tax

Q50: Which sequence is arranged in the correct

Q70: Which of the following is not likely

Q76: Siebling Manufacturing Company's common shares has a

Q95: Debentures are unsecured long-term debt.

Q102: You are going to pay $800 into