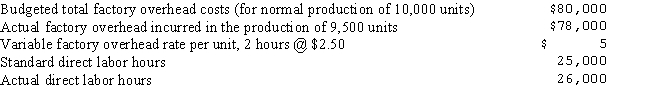

Baker Company has a standard and flexible budgeting system and uses a two-variance analysis of factory overhead.Selected data for the June production activity follows:  The production-volume variance for June is:

The production-volume variance for June is:

Definitions:

Depreciated

Depreciation is the process of allocating the cost of a tangible asset over its useful life, reflecting the asset's wear and tear, deterioration, or obsolescence.

Operating Lease

A contract that allows for the use of an asset but does not convey rights of ownership of the asset, with payments made over a shorter period than the asset's useful life.

Lease Obligation

A financial commitment that represents the future payments an entity is obligated to make under lease agreements.

Statement of Financial Position

A financial report detailing an entity's assets, liabilities, and shareholders' equity at a specific point in time, offering a snapshot of its financial status.

Q4: In a [blank], the life of the

Q8: Managing funding for the company's day-to-day operations

Q13: Profit maximisation is not an adequate goal

Q20: Established firms in need of additional capital

Q30: Chase Company's new product is expected to

Q37: An accrued expense such as Wages Payable

Q43: Which of the following is most likely

Q45: A cost driver is:<br>A)An overhead or activity

Q68: The business entity that converts purchased raw

Q69: A firm's Treasurer is typically responsible for