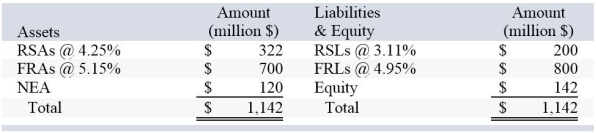

After conducting a rate-sensitive analysis,a bank finds itself with the following amounts of rate-sensitive assets and liabilities (RSAs and RSL) and fixed-rate assets and liabilities (FRAs and FRLs) ; the rate of return and cost rates on the accounts are also given:  Suppose the institution wishes to fully hedge the interest rate risk with a swap. A swap is available with whatever notional principal is needed that pays fixed at 4.95 percent and pays variable at LIBOR. LIBOR is currently 5.11 percent. By how much would profits change right now if the bank engages in the swap?

Suppose the institution wishes to fully hedge the interest rate risk with a swap. A swap is available with whatever notional principal is needed that pays fixed at 4.95 percent and pays variable at LIBOR. LIBOR is currently 5.11 percent. By how much would profits change right now if the bank engages in the swap?

Definitions:

T-bond Futures

Financial contracts obligating the buyer to purchase U.S. Treasury bonds at a specified price at a future date, used for hedging and investment purposes.

Cross-hedge

A hedging strategy using a contract that has price movements correlated with, but not identical to, the asset being hedged.

Long Futures Contract

An agreement to buy a particular commodity or financial instrument at a predetermined price at a specified time in the future, indicating the buyer's bullish outlook.

Asset Price

The current market value or price at which an asset, such as a stock, bond, or commodity, can be bought or sold.

Q1: Good decisions can reveal unfavourable information,and bad

Q4: Which of the following could be a

Q6: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6854/.jpg" alt=" If FNBNA is

Q8: Which of the following is an assumption

Q9: Writing a call option on a bond

Q13: If you invest $10,000 in a mutual

Q16: Which of the following is an advantage

Q17: Ordinary shares are:<br>A)investments in which the investors

Q54: What new rules have resulted from the

Q59: _ is the process of taking possession