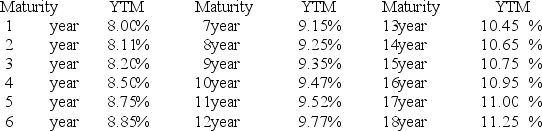

YIELD CURVE FOR ZERO COUPON BONDS RATED AA

Assume that there are no liquidity premiums.

To the nearest basis point,what is the expected interest rate on a four-year maturity AA zero coupon bond purchased six years from today?

Definitions:

Waiting Line

Queues formed when the demand for a service exceeds the immediate capacity to provide it, necessitating wait times for service completion.

Knowledge

Information, understanding, and skills that individuals acquire through experience or education; the theoretical or practical understanding of a subject.

Multiple Servers

A system configuration that uses more than one server to handle tasks, improving capacity and reliability.

M/M/1

A basic queueing model in operations research representing a system with a single server, Poisson arrival rate, and exponential service time distribution.

Q1: If a security's realized return is negative,it

Q15: Suppose that oil prices hit an all-time

Q16: The C<sub>p</sub> index equals the C<sub>pk</sub> index

Q22: Which of the following is a characteristic

Q23: Which of the following restructuring actions is

Q28: If a firm is very decentralized and

Q34: Discuss the benefits to funds suppliers of

Q39: According to the resource-based view of the

Q44: The NYSE is an example of a

Q54: Data show that since 1942,only 8 of