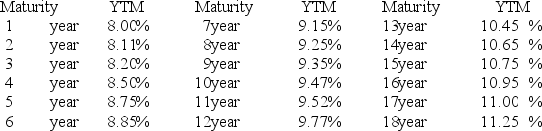

YIELD CURVE FOR ZERO COUPON BONDS RATED AA

Assume that there are no liquidity premiums.

You just bought a 15-year maturity Xerox corporate bond rated AA with a 0 percent coupon. You expect to sell the bond in eight years. Find the expected interest rate at the time of sale (watch out for rounding error) .

Definitions:

Second Great Awakening

A Protestant religious revival during the early 19th century in the United States, emphasizing personal salvation, emotional response, and individual faith.

Christian Blacks

African American individuals who practice Christianity, bringing unique cultural and historical perspectives to their faith and church communities.

White Slaveholders

Individuals of European descent who owned and exploited enslaved African people for labor and profit in historical contexts, primarily in the Americas.

David Walker

An African American abolitionist, writer, and anti-slavery activist in the 19th century known for his 1829 pamphlet, "Walker's Appeal," which called for black unity and self-help in the fight against oppression and injustice.

Q1: A strategic control system helps managers to

Q4: Professor Murphy wants to set up a

Q7: What is the difference between a tangible

Q7: The Fed increases bank reserves in the

Q8: External stakeholders are groups or individuals outside

Q11: What is convexity? How does convexity affect

Q17: _ and _ allow a financial intermediary

Q21: The diagram below is a diagram of

Q26: An interest rate floor is designed to

Q32: Among the following,the best definition of technology