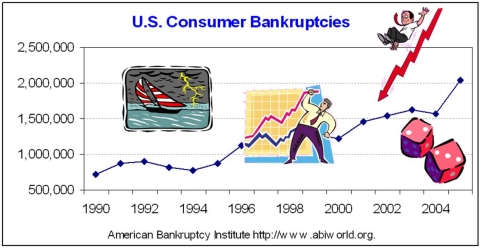

Briefly list strengths and weaknesses of this display.Cite specific principles of good graphs,as well as offering your own general interpretation.

Definitions:

Tax Revenues

The income that is gained by governments through taxation, which is used to fund public services, government obligations, and goods.

Benefits Principle

A concept that suggests taxes should be levied based on the benefits received by taxpayers, ensuring that those who benefit more from public services pay more taxes.

Ability-To-Pay Principle

The ability-to-pay principle is a tax theory suggesting that taxes should be levied based on the taxpayer’s capacity to pay, implying that wealthier individuals should pay more in taxes.

Gasoline Tax

A tax imposed on the sale of gasoline, often used by governments to raise revenue and discourage excessive fuel consumption.

Q19: Which is not an essential characteristic of

Q24: A new policy of "flex hours" is

Q39: Find the sample correlation coefficient for the

Q58: When applying the Empirical Rule to a

Q71: The following frequency distribution shows the amount

Q95: Of the following,the one that most resembles

Q96: In Tokyo,construction workers earn an average of

Q96: In a test for equality of two

Q104: A population is of size 5,500 observations.When

Q121: For any event A,the probability of A