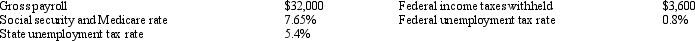

Use this information to answer the following question. Panadora Company has the following information for the pay period of January 1-15,2014.Payment occurs on January 20. Payroll Taxes and Benefits Expense would be recorded for

Payroll Taxes and Benefits Expense would be recorded for

Definitions:

Capital Gains

The profit from the sale of an asset or investment when the selling price exceeds the original purchase price.

Marginal Tax Rates

Marginal tax rates are the rates of tax applied to the next dollar of income, used to determine the tax impact of additional income or deductions.

Total Tax

The sum of all taxes levied on an individual or a corporation by various governmental agencies.

Provincial Tax Brackets

These refer to the range of income segments taxed at different rates by provincial governments in countries like Canada, where taxation powers are shared between federal and provincial authorities.

Q5: A company has net sales of $50,000

Q35: Present two arguments in favor of the

Q46: Which of the following is not a

Q60: How is it possible for a corporation

Q60: Marta Company has the following bank items:

Q76: One argument in favor of accelerated depreciation

Q96: Dividend yield is the most important ratio

Q130: In some liquidations,a partner's share of the

Q133: Under tax depreciation,estimated useful life and residual

Q155: The purpose of a statement of stockholders'