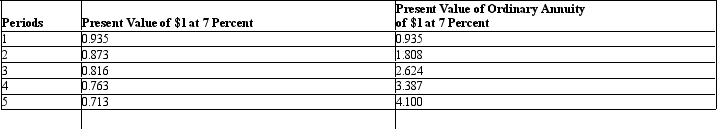

Use this information to answer the following question.  You have the opportunity to purchase a machine for $10,000.After careful study of expected costs and revenues,you estimate that the machine will produce a net cash flow of $3,200 annually and will last 5 years.Based on an interest rate of 7 percent,determine the present value of the machine and if the machine should be purchased.

You have the opportunity to purchase a machine for $10,000.After careful study of expected costs and revenues,you estimate that the machine will produce a net cash flow of $3,200 annually and will last 5 years.Based on an interest rate of 7 percent,determine the present value of the machine and if the machine should be purchased.

Definitions:

Horizontal Analysis

A financial analysis technique that compares historical financial data over a series of reporting periods to identify trends and growth patterns.

Vertical Analysis

A method of financial statement analysis in which each entry for each of the three major categories of accounts (assets, liabilities, and equities) in a balance sheet is represented as a proportion of the total account.

Balance Sheet Data

The information presented on a balance sheet, which includes assets, liabilities, and shareholders' equity at a specific point in time.

Solvency

The ability of a company to meet its long-term financial obligations and continue its operations into the foreseeable future.

Q2: Under a capital lease,the lessee records both

Q51: Limited liability can be viewed as both

Q82: If liquidation of a partnership results in

Q97: A specialized piece of equipment closely associated

Q111: On December 31,20x5,the X&Y Partnership had the

Q119: Carrying value<br>A)equals cost minus accumulated depreciation.<br>B)equals cost

Q123: When calculating a partial year's depreciation,the length

Q144: A negative free cash flow means that

Q157: The entry that includes a debit to

Q165: Accounting for a defined contribution pension plan