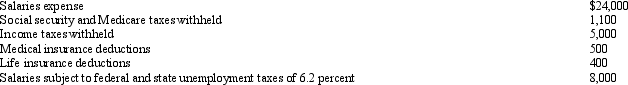

Use this information to answer the following question. The following totals for the month of September were taken from the payroll register of Meadors Company: The entry to record the accrual of employer's payroll taxes would include a debit to Payroll Taxes and Benefits Expense for

The entry to record the accrual of employer's payroll taxes would include a debit to Payroll Taxes and Benefits Expense for

Definitions:

Break-Even Analysis

A financial calculation to determine the sales volume at which total revenues equal total costs, resulting in no profit or loss.

Fixed Costs

Expenses that do not vary with the level of production or sales, such as rent or salaries.

Variable Cost

Expenses that vary proportionally with the level of production or service output, such as materials or labor costs.

Capacity

The maximum amount of work or production an organization is capable of completing in a specified period.

Q9: Small expenditures for what ordinarily are considered

Q15: Securitization delays the receipt of cash from

Q37: One might infer from a debit balance

Q61: When the existing partners pay a bonus

Q76: Treasury stock is considered a reduction in

Q88: The costs associated with the development of

Q108: Which of the following is incorrect regarding

Q115: The information that follows pertains to stockholders'

Q117: Each partner is personally liable only for

Q120: If a capital expenditure is incorrectly recorded