Paul,Quinn,and Ralph Have Equities in a Partnership of $120,000,$180,000,and $100,000,respectively,and

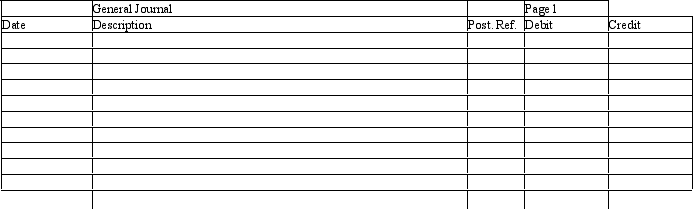

Paul,Quinn,and Ralph have equities in a partnership of $120,000,$180,000,and $100,000,respectively,and share income and losses in a ratio of 2:1:2,respectively.The partners have agreed to admit Sandy to the partnership.Prepare entries in journal form without explanations to record the admission of Sandy to the partnership under each of the following assumptions:

a.Sandy invests $100,000 for a 30 percent interest,and a bonus is recorded for Sandy.

b.Sandy invests $150,000 for a one-fifth interest,and a bonus is recorded for the old partners.

Definitions:

Cafeteria

A type of food service location within an institution where there is a selection of different meals available, generally serving food in a self-service manner.

Service Department

A division within a company that performs support functions, aiding the production or sales departments but not generating revenue directly.

Information Technology

The use of computers, storage, networking and other physical devices, infrastructure, and processes to create, process, store, secure, and exchange all forms of electronic data.

Operating Departments

Divisions within an organization directly involved in its core business activities, such as production or sales.

Q4: The primary purpose of the statement of

Q30: Property Taxes Expense is recorded only in

Q44: Under an operating lease,the lessee records which

Q51: Admission of a new partner never has

Q88: Analysis of the financing activities section of

Q93: Calculate answers to the following scenarios:<br>a. To

Q100: The word preferred in the phrase preferred

Q109: According to generally accepted accounting principles,the proper

Q115: The interest coverage ratio is expressed as

Q179: Which of the following is not considered