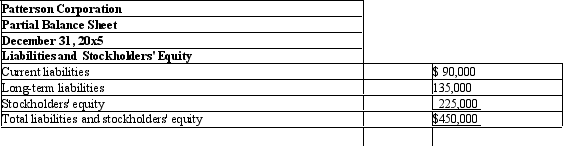

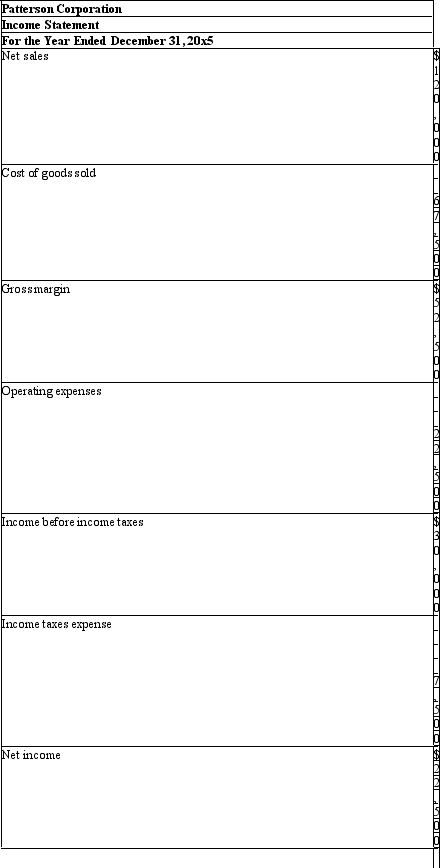

The following information pertains to Patterson Corporation.Assume that all balance sheet amounts represent both average and ending figures.

Patterson Corporation had 6,000 shares of common stock issued and outstanding.The market price of Patterson common stock on December 31,20x5,was $23.Patterson paid dividends of $0.90 per share during 20x5.

Patterson Corporation had 6,000 shares of common stock issued and outstanding.The market price of Patterson common stock on December 31,20x5,was $23.Patterson paid dividends of $0.90 per share during 20x5.

What is the price/earnings (P/E) ratio for this corporation? Round your answer to two decimal places.

Definitions:

Distorting Tax

A tax that alters the economic behavior of individuals and businesses from what they would have chosen in the absence of the tax.

Economic Welfare

The overall well-being of individuals and societies, often assessed by factors such as wealth, health, and happiness.

Benefits-Received Principle

The concept that those who benefit from public goods and services should bear the costs of providing them, in proportion to the benefit received.

Progressive Income Tax

A tax system where the tax rate increases as the taxable amount increases, placing a higher burden on wealthier individuals.

Q9: Cash inflows and outflows are not netted

Q14: Technically,what is meant by the amortization of

Q17: Sketch the region enclosed by <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2067/.jpg"

Q22: Find the area of the surface S

Q23: Find the velocity,acceleration,and speed of an object

Q26: The statement of cash flows explains the

Q41: A swimming pool is 10 ft wide

Q45: The fewer debt securities a corporation issues,the

Q62: Evaluate the limit. <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2067/.jpg" alt="Evaluate the

Q86: Why might someone prefer to invest in