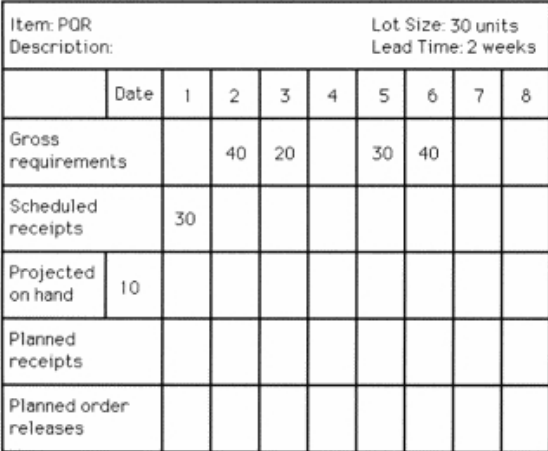

Table 13.6

-Use the information from Table 13.6. What is the planned receipts quantity in week 3?

Definitions:

Straight-Line Depreciation

Straight-line depreciation is a method of evenly distributing the cost of a tangible asset over its useful life.

Income Taxes

Taxes levied on the income of individuals or businesses by the government.

Operating Cash Inflow

Cash generated from the core business operations of a company during a specific period.

Straight-Line Depreciation

An approach to evenly spread the expense of an asset over its period of utility.

Q4: Explain why a sampling schedule is important

Q6: The _ is the length of time

Q6: Which of the following statements about performance

Q12: In the fixed-position layout,the product is fixed

Q46: Use the information in Table 10.6.Use the

Q59: The Classical Consultant Company provides forecasting research

Q66: A worker was observed for four cycles

Q72: The square nodes in a decision tree

Q85: Forecasting capacity needs is not generally considered

Q100: Use the information from Table 13.7.If a