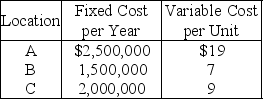

Excel Products is planning a new warehouse to serve the Southeast.Locations A,B,and C are under consideration.Fixed and variable costs follow:  Plot the total cost curves in the chart provided below,and identify the range over which each location would be best.Then use break-even analysis as necessary to calculate exactly the break-even quantity that defines each range.

Plot the total cost curves in the chart provided below,and identify the range over which each location would be best.Then use break-even analysis as necessary to calculate exactly the break-even quantity that defines each range.  Which of the following statements is correct?

Which of the following statements is correct?

Definitions:

Salvage Value

The estimation of an asset's value at the end of its period of utility.

Depreciation

The systematic allocation of the cost of a tangible asset over its useful life, representing the wear and tear or obsolescence of the asset.

Service Life

The expected period during which an asset is considered useful and productive in a business operation, also known as useful life.

Units-Of-Production

A depreciation method that allocates the cost of an asset based on its usage, production, or units of output over its useful life.

Q1: Using Table 3.4,what is the latest finish

Q34: Using Table 3.8,what is the slack for

Q67: Use the information in Table 9.5.Assume that

Q68: One of the basic time series patterns

Q83: Aggregating products or services together generally decreases

Q116: One chart commonly used for quality measures

Q131: The _ variable is the variable that

Q145: Use the information in Table 7.3.How many

Q158: Relative to product layouts,an advantage of process

Q187: Use the information from Table 9.23,and the