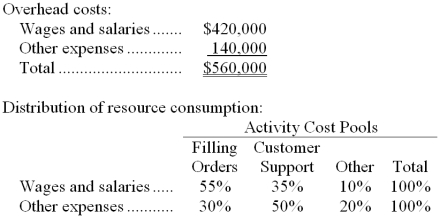

Eschbach Company is a wholesale distributor that uses activity-based costing for all of its overhead costs. The company has provided the following data concerning its annual overhead costs and its activity based costing system:  The "Other" activity cost pool consists of the costs of idle capacity and organization-sustaining costs.

The "Other" activity cost pool consists of the costs of idle capacity and organization-sustaining costs.

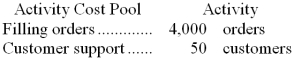

The amount of activity for the year is as follows:

-To the nearest whole dollar, how much wages and salaries cost would be allocated to a customer who made 6 orders in a year?

Definitions:

General Partnership

A business structure where two or more individuals own and operate a business together, sharing profits and liabilities equally or according to their agreement.

Partnership Agreement

A legal document that outlines the rights, responsibilities, and profit-sharing among business partners.

Partnership Debts

Liabilities or financial obligations incurred by a partnership in the course of its business activities.

Limited Liability

This refers to a business structure where the owners' personal assets are protected from company debts and liabilities.

Q1: The R<sup>2</sup> (i.e. ,R-squared) indicates the proportion

Q4: Suppose an investment has cash inflows of

Q19: The nurse is conducting a class on

Q22: The nurse is examining a client's neck.Which

Q22: The nursing instructor is demonstrating,to a group

Q26: During step 3 of the nursing process,which

Q56: Gloster Company makes three products in a

Q71: In addition to the facts given above,assume

Q116: Tjelmeland Corporation is considering dropping product S85U.Data

Q123: Gudger Corporation processes sugar cane in batches.The