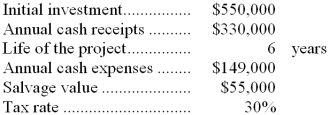

Wable Inc. has provided the following data to be used in evaluating a proposed investment project:  For tax purposes, the entire initial investment without any reduction for salvage value will be depreciated over 5 years. The company uses a discount rate of 16%.

For tax purposes, the entire initial investment without any reduction for salvage value will be depreciated over 5 years. The company uses a discount rate of 16%.

-When computing the net present value of the project, what is the annual amount of the depreciation tax shield? In other words, by how much does the depreciation deduction reduce taxes each year in which the depreciation deduction is taken?

Definitions:

Public Perception

The collective attitudes, beliefs, and impressions held by the general public about a particular subject or entity.

Social Enterprise

Businesses that operate with the primary objective of addressing social problems, combining commercial strategies with the pursuit of social and environmental goals.

Joint Venture

A business arrangement where two or more parties agree to pool their resources for a specific task or venture, sharing both profits and risks.

Risks And Benefits

The potential negative and positive outcomes associated with any action or decision.

Q5: During the assessment of a client's eyes,the

Q12: The nurse is completing discharge teaching to

Q16: The nurse needs to take a blood

Q18: The nurse manager is discussing cultural considerations

Q27: The nurse is performing an assessment on

Q29: The incremental net present value in favor

Q31: The internal rate of return of the

Q47: The fixed manufacturing overhead budget variance and

Q63: What is the differential cost of Alternative

Q105: Consider a decision facing a company of