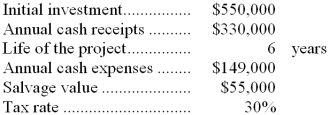

Wable Inc. has provided the following data to be used in evaluating a proposed investment project:  For tax purposes, the entire initial investment without any reduction for salvage value will be depreciated over 5 years. The company uses a discount rate of 16%.

For tax purposes, the entire initial investment without any reduction for salvage value will be depreciated over 5 years. The company uses a discount rate of 16%.

-When computing the net present value of the project, what is the after-tax cash flow from the salvage value in the final year?

Definitions:

Excel Spreadsheets

A software program used for data organization, analysis, and storage in tabular form.

Profitability Index

A financial tool used to evaluate the attractiveness of an investment, calculated as the present value of future cash flows divided by the initial investment.

Net Present Value

A valuation method that calculates the worth of a future stream of cash flows by discounting them back to their present value.

IRR

Internal Rate of Return; a financial metric used to estimate the profitability of potential investments, calculating an annual growth rate.

Q8: The nurse using the body mass index

Q9: Consider the following statements: I.A vertically integrated

Q12: The nurse is caring for a Jewish

Q15: The nurse is admitting a 69-year-old client

Q16: The nurse is assessing a client's visual

Q26: If the predetermined overhead rate is based

Q26: The adult caregiver of an elderly client

Q39: An investment project that requires a present

Q64: The division's margin is closest to:<br>A)9.9%<br>B)3.1%<br>C)34.5%<br>D)31.4%

Q77: Rank the projects according to the profitability